On the brink of a historic shift in global markets, stablecoins have already surpassed USD $230 billion in market value and are projected to drive over $1 trillion in U.S. Treasury purchases by 2030. This is the scenario presented in Digital Dollars, a report from the Citi Institute, combining insights from Citi, PwC, and the World Bank to show how recent regulations, from the European MiCA to the U.S. executive order issued in January 2025, are about to catapult blockchain and digital assets to the center of finance and public administration.

Published as part of the Global Perspectives & Solutions series by Citigroup Global Markets, the study was coordinated by the Citi Institute with contributions from experts at the World Bank, Stellar Foundation, Mastercard, PwC, and other leaders from multilateral organizations and governments.

Stablecoins Powering a New Financial Era

The report highlights that, by the end of March 2025, the total value of stablecoins exceeded USD $230 billion, thirty times more than in 2020, driven by the growing integration of digital assets into traditional financial institutions and macroeconomic factors such as rising demand for the U.S. dollar in emerging markets.

The scenario analysis projects that, under a base case, stablecoin supply could reach USD $1.6 trillion by 2030, ranging from $0.5 trillion (pessimistic) to $3.7 trillion (optimistic).

This growth brings a highly relevant side effect for the U.S. Treasury market: a clear regulatory framework for stablecoins would require issuers to fully back each unit with low-risk assets, potentially resulting in over USD $1 trillion in new Treasury purchases by 2030. This would place stablecoin issuers among the largest institutional holders of U.S. government debt.

The timing of this transformation is attributed to recent regulatory advancements, such as the Markets in Crypto Assets Regulation (MiCA) in the European Union and the U.S. executive order from January 2025, which created a task force to design a federal framework for digital assets, creating a favorable environment for integrating stablecoins into traditional payment systems.

From the perspective of financial institutions, stablecoins are not only a new store of value, but also a vector for innovative products. Banks can serve as custodians of Treasury reserves, intermediaries in bond markets, liquidity managers for stablecoin issuers, or even use these digital currencies as payment infrastructure, including integration into card networks and 24/7 settlement solutions.

Public Sector Revolution with Blockchain Technology

In the public sector, blockchain emerges as a tool for modernizing legacy processes, with use cases ranging from real-time public spending tracking and subsidy management to document registry, humanitarian aid, asset tokenization, and digital identity.

A flagship example is FundsChain, a World Bank platform developed in partnership with EY to track project disbursements and spending in real time. By replacing manual reports with tokens representing each transaction, the system ensures visibility and trust that funds reach the correct beneficiaries, helping combat fraud and reduce operational costs.

In public records management, solutions like Singapore’s OpenCerts enable tamper-proof issuance and verification of academic certificates, while property registry projects in Georgia use Bitcoin to validate ownership transactions, enhancing the security and efficiency of notarial services.

In crisis scenarios, blockchain technology is also being used in humanitarian campaigns. The UNHCR, through the Stellar network, implemented a system to track real-time aid distribution to refugees, ensuring transparency and autonomy for individuals without access to traditional banking services.

Asset tokenization further expands blockchain’s potential in the public sector. The European Investment Bank issued its first digital bond of EUR 100 million in 2021 and launched Project Venus in 2022, featuring a tokenized eurobond on a private blockchain using wholesale CBDC. Similar initiatives are underway in cities like Lugano, Switzerland.

Digital identity is also progressing with programs like Zug’s self-sovereign IDs on Ethereum since 2017, and Brazil’s b-Cadastros, a Federal Revenue of Brazil (Receita Federal do Brasil — RFB) initiative in partnership with Serpro (Federal Data Processing Service), which provides a blockchain-based data-sharing platform for states, municipalities, and public administration agencies.

Challenges and the “ChatGPT Moment”

Despite promising prospects, the report warns of significant challenges: the need for interoperability standards, high costs of legacy infrastructure transformation, concerns over privacy and confidentiality, and the urgent need for clear regulatory frameworks and mechanisms to mitigate illicit use.

The year 2025, according to Digital Dollars, could be blockchain’s “ChatGPT moment”, a turning point where digital assets and decentralized applications intertwine with financial and public systems, driven by greater regulatory clarity and modernization initiatives.

If the projected trends hold, the coming decades will witness a revolution in how value and information are managed, fostering efficiency, transparency, and trust in global institutions.

Access the full report here:

Digital Dollars - Banks and Public Sector Drive Blockchain Adoption

Want to learn how to adopt stablecoins and blockchain to transform your financial operations and institutional management?

Contact our team of specialists or schedule a demo on our website.

About Wireshape

Wireshape is a consultancy firm in digital assets, empowering financial institutions and fintechs to achieve regulatory compliance by guiding them in designing business models and modular blockchain architectures.

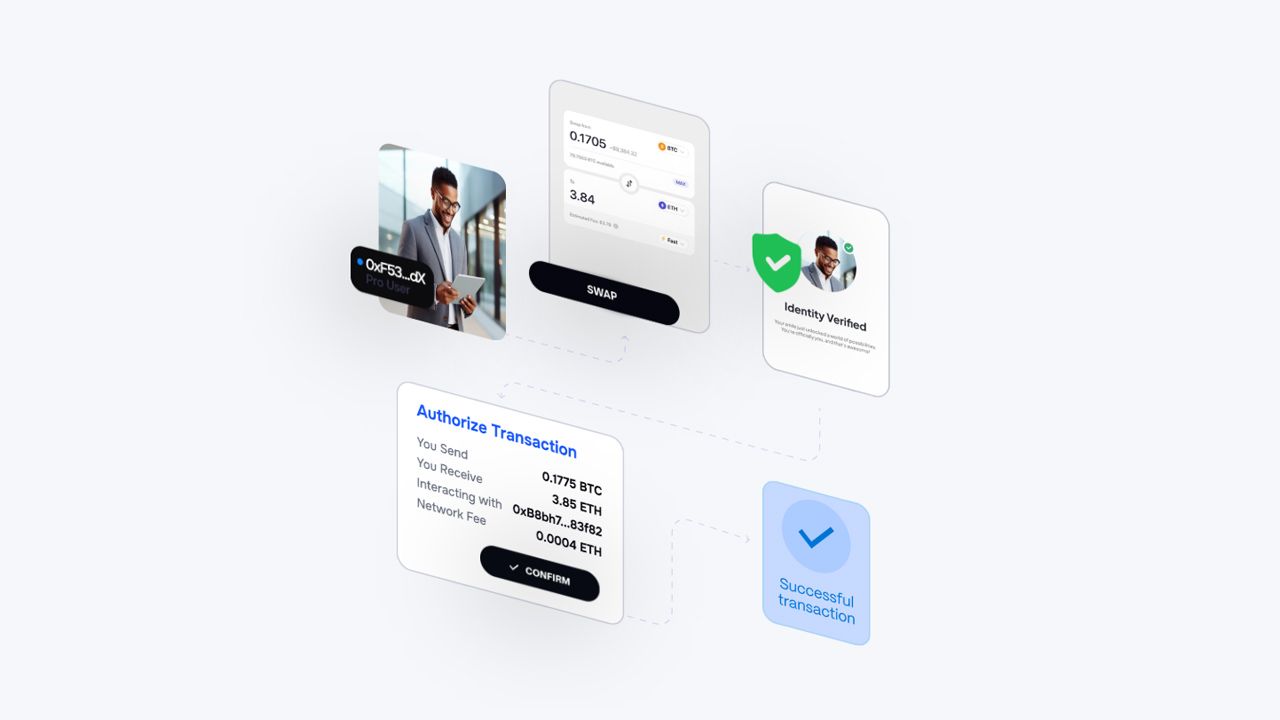

We also develop smart contracts, on-chain protocols and oracles, build dApps, and integrate blockchain systems with legacy infrastructure. Wireshape is the creator of Levery, a next-generation digital asset exchange infrastructure that bridges TradFi and DeFi. Levery enables banks and fintechs to launch and operate their own fully regulation-compliant DeFi platforms, with KYC/AML monitoring, dynamic fee adjustments, and price syncing via oracles.

Incubated by Uniswap, accelerated by Santander X, and supported by the Brazilian Federal Government through RNP, Levery is redefining the institutional decentralized finance landscape.

Wireshape — Website | X (Twitter) | LinkedIn | Levery