This new asset management model has received a lot of attention in recent years, and real estate funds are looking into it as a way to improve their operations and provide new investment opportunities to their clients. In this post, we'll look at why real estate funds are tokenizing assets and how it can help the industry.

Increased Liquidity

One of the primary advantages of tokenizing real estate is that it can significantly increase asset liquidity. Because tokenized real estate is digitized and can be stored and traded on blockchain networks, it is easily traded and transferred. This facilitates the movement of assets and the provision of new investment opportunities to real estate funds' clients.

Improved Accessibility

Tokenization has the potential to make a wider range of real estate assets more accessible. Real estate can be easily divided and traded in smaller units thanks to digitization, allowing a broader range of investors to access these assets. This can help to increase the overall liquidity of real estate assets and provide individuals with more investment opportunities.

Reduced Costs

It has the potential to drastically reduce the costs of traditional real estate management. Real estate funds can save significant amounts of money in the long run by eliminating intermediaries and reducing the need for manual processes. This can help to improve efficiency while also making real estate investment more accessible to a broader range of customers.

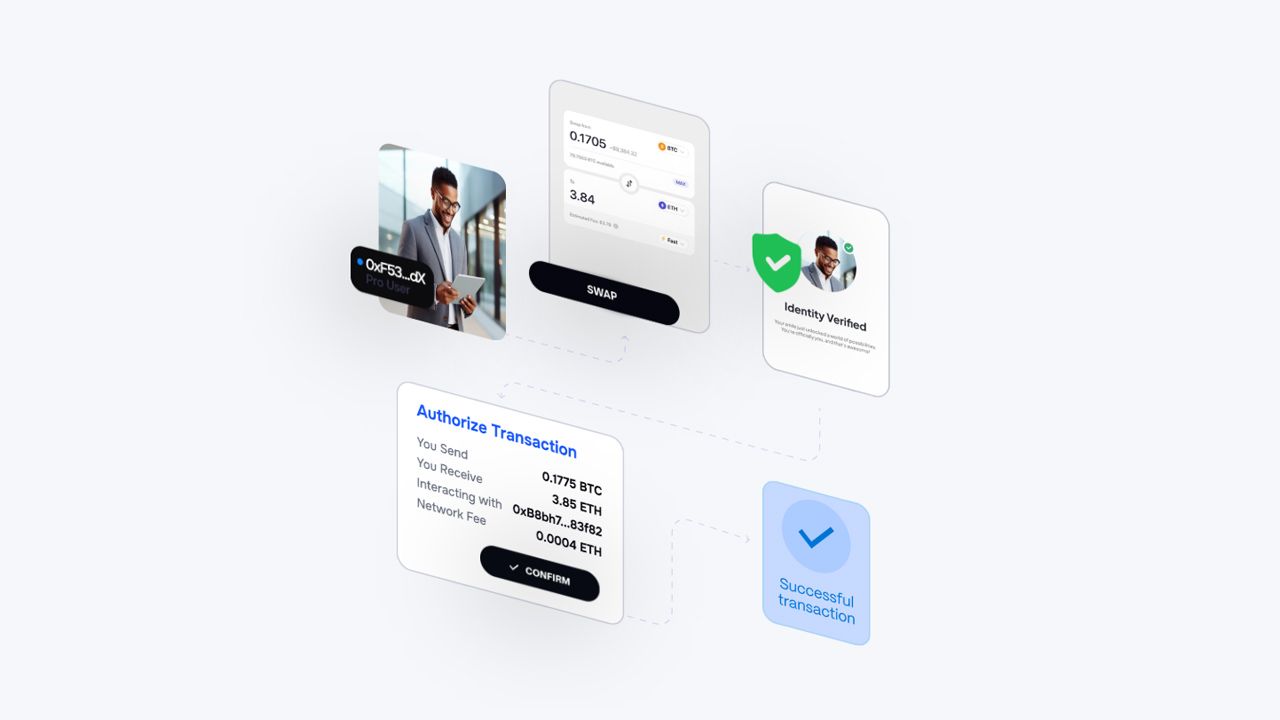

Improved Transparency

Another advantage of tokenizing real estate is that it can improve transparency. On blockchain networks, all transactions and ownership information can be easily recorded and tracked, increasing accountability and trust. This can help reduce fraud and improve the overall security of real estate assets.

Competitive Advantage

Real estate funds are investigating tokenization as a way to maintain a competitive advantage in a rapidly changing market. With the rise of new technologies, real estate funds are looking for innovative solutions to help them stay competitive and provide their clients with the most up-to-date and innovative investment opportunities.

Real estate tokenization provides a variety of benefits to the industry, including increased liquidity, accessibility, transparency, and cost savings. It's no surprise that real estate funds are looking into this technology to improve their operations and provide new investment opportunities to their clients. The future of real estate investment is rapidly changing, and it will be fascinating to see how tokenization shapes the industry in the coming years.

About Wireshape

Wireshape is a new and open layer-1 blockchain dedicated to decentralizing global product data, making it useful for consumers to have real, complete, and relevant information about a product before it is purchased, ensuring greater satisfaction by acquiring what was really expected. Wireshape delivers a new product data standard, open and audited by the community. Consumers themselves, as well as manufacturers, are able to suggest and validate the fidelity of product information publicly recorded on the blockchain.